PPC Urban conducts Special Disability Accommodation (SDA) Needs Assessment to help clients identify where to invest and what type of SDA housing to invest in. This will maximise our clients return on investment through selecting suitable products and the appropriate scale of development. We then manage our client’s town planning application promptly to minimise holding costs and allow them to plan for the building stage.

This can be for a specific site or on a metropolitan or regional scale across Australia.

For the purposes of this page, the following information is relevant for a site-specific SDA assessment for development purposes.

Under the National Disability Insurance Scheme (NDIS), funding for SDA participants with high support needs or who meet the criteria is paid directly to SDA providers.

It is a growing industry driven by old housing stock falling into obsolescence, growing SDA demand with long waitlists for existing stock and insufficient SDA dwelling construction. Commitment from the federal government to increase funding to existing participants and new participants will help drive private investment in SDA housing.

Key Components of Specialist Disability Accommodation Market Assessments

Our needs assessments are informed by trusted primary (i.e. direct interviews with providers) and secondary sources (i.e. government published information).

To inform the marketability of a given proposal, our Specialist Disability Accommodation usually includes:

- Location and Site Context,

- Setting up a Catchment area,

- Key Demographic and Economic Outlook,

- Supply Assessment – Existing SDA dwelling stock by build type and design category,

- Development Pipeline Information – New SDA dwelling stock by build type and design category,

- Identifying growth in SDA demand within the catchment by build type and design category

Demand Assessment – informed by a detailed review of existing stock, identifying growth in SDA demand within the catchment by build type and design category as well as current provision ratio,

- Market Gap Estimates – estimating the number of dwellings needed to meet the demand, triggered by population growth, SDA demand growth and area income, and

- Feasibility scenarios – The feasibility of on-demand building types and categories will be evaluated. If the client’s desired building type and design category are not feasible, an alternative SDA development with a different building type and/or design category will be proposed.

- 14-day turnaround with a PDF digital version sent via email.

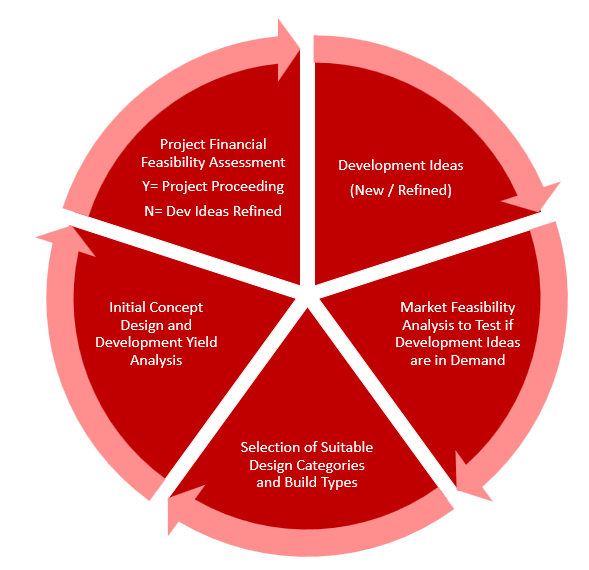

Below is a thinking process that PPC Urban has adopted to maximise our clients’ return on investment, from creating new development ideas, and all the way to validating and implementing most profitable ideas.

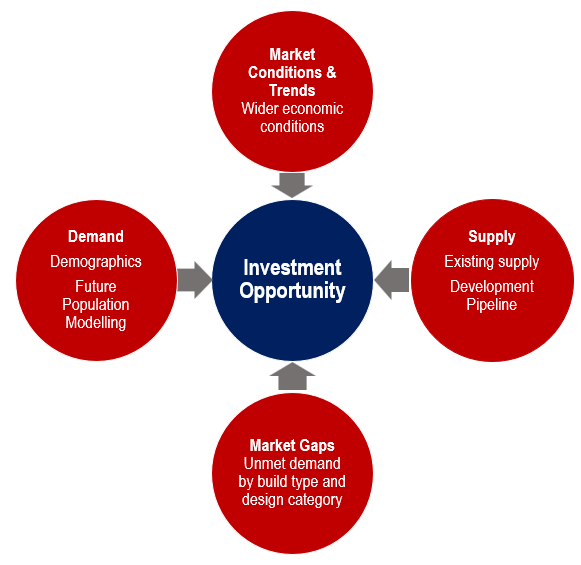

Our approach to find out the most wanted SDA housing products is illustrated in the diagram below, via an needs analysis of market gaps, risks and opportunities.

Our Director, Hong Knowling, was interviewed by NDIS Property Australia. Our Podcast is published below via the link.

Episode 23 – PPC URBAN: Town Planning and SDA Potential on Sites – SDA HOUSING | Podcast on Spotify